You might be an investor who wants to know if anyone owns stocks. It is vital information that can help you to make informed investment decisions. It is important to understand the stock market, including how it works and what you can expect.

Stock Ownership Search

When you buy a stock, you will usually receive a certificate from the company that shows the number of shares and other information. You should keep these certificates, as they contain valuable information.

How to prove that you own stock

The easiest way to prove your stock ownership is to go through the paperwork you signed when you purchased the stock and verify that it matches up with what you have in your records. For many, this can be a difficult task. However, it is important to protect your financial interest.

Use the information from the website of the business to confirm that it is accurate. You can then use it to prove that you are the owner of the stock, and you have the right vote in corporate matters.

Another option is to find a company that will print out physical copies of your certificates for you. You can choose from a variety of templates and blanks, and the company will take care of all legal requirements.

How to find a transfer agent for your stock

A stock ownership certificate is important because it shows you own the stocks that you have purchased. This is a useful tool for collecting dividends that you may be entitled to. It is important to replace the lost certificate as soon as you can.

The transfer agent is responsible for maintaining all records of shareholders, transferring these to new owners, and ensuring that dividends are paid. Select a transfer agent who is registered with SEC and has an excellent reputation. You should also ask them about their experience in the field.

For a complete view of the company's shareholders, you must know who has owned it historically and currently. You will be able to gain a better understanding of the stock market as well as the overall health and performance of a business.

For current stockholders, BamSec offers a search function that allows you to view a list of holders. The tool also allows you to filter by concentration (top 10), location, type of investors and date range.

If you need a list, "Shareholder History report" is a feature that can be used. The report will give you a list with all the holders, as well their holdings history from 1997 up to today.

FAQ

Why is marketable security important?

A company that invests in investments is primarily designed to make investors money. It does so by investing its assets across a variety of financial instruments including stocks, bonds, and securities. These securities have attractive characteristics that investors will find appealing. They may be safe because they are backed with the full faith of the issuer.

It is important to know whether a security is "marketable". This refers primarily to whether the security can be traded on a stock exchange. If securities are not marketable, they cannot be purchased or sold without a broker.

Marketable securities can be government or corporate bonds, preferred and common stocks as well as convertible debentures, convertible and ordinary debentures, unit and real estate trusts, money markets funds and exchange traded funds.

These securities are preferred by investment companies as they offer higher returns than more risky securities such as equities (shares).

What is a mutual fund?

Mutual funds are pools that hold money and invest in securities. Mutual funds provide diversification, so all types of investments can be represented in the pool. This helps reduce risk.

Professional managers are responsible for managing mutual funds. They also make sure that the fund's investments are made correctly. Some funds offer investors the ability to manage their own portfolios.

Mutual funds are often preferred over individual stocks as they are easier to comprehend and less risky.

How do you choose the right investment company for me?

You should look for one that offers competitive fees, high-quality management, and a diversified portfolio. The type of security that is held in your account usually determines the fee. Some companies charge no fees for holding cash and others charge a flat fee per year regardless of the amount you deposit. Others charge a percentage on your total assets.

Also, find out about their past performance records. If a company has a poor track record, it may not be the right fit for your needs. You want to avoid companies with low net asset value (NAV) and those with very volatile NAVs.

Finally, you need to check their investment philosophy. To achieve higher returns, an investment firm should be willing and able to take risks. They may not be able meet your expectations if they refuse to take risks.

How does Inflation affect the Stock Market?

Inflation can affect the stock market because investors have to pay more dollars each year for goods or services. As prices rise, stocks fall. It is important that you always purchase shares when they are at their lowest price.

What is security in the stock exchange?

Security is an asset that generates income for its owner. Shares in companies is the most common form of security.

A company may issue different types of securities such as bonds, preferred stocks, and common stocks.

The earnings per share (EPS), and the dividends paid by the company determine the value of a share.

When you buy a share, you own part of the business and have a claim on future profits. You receive money from the company if the dividend is paid.

You can sell your shares at any time.

Statistics

- "If all of your money's in one stock, you could potentially lose 50% of it overnight," Moore says. (nerdwallet.com)

- Even if you find talent for trading stocks, allocating more than 10% of your portfolio to an individual stock can expose your savings to too much volatility. (nerdwallet.com)

- The S&P 500 has grown about 10.5% per year since its establishment in the 1920s. (investopedia.com)

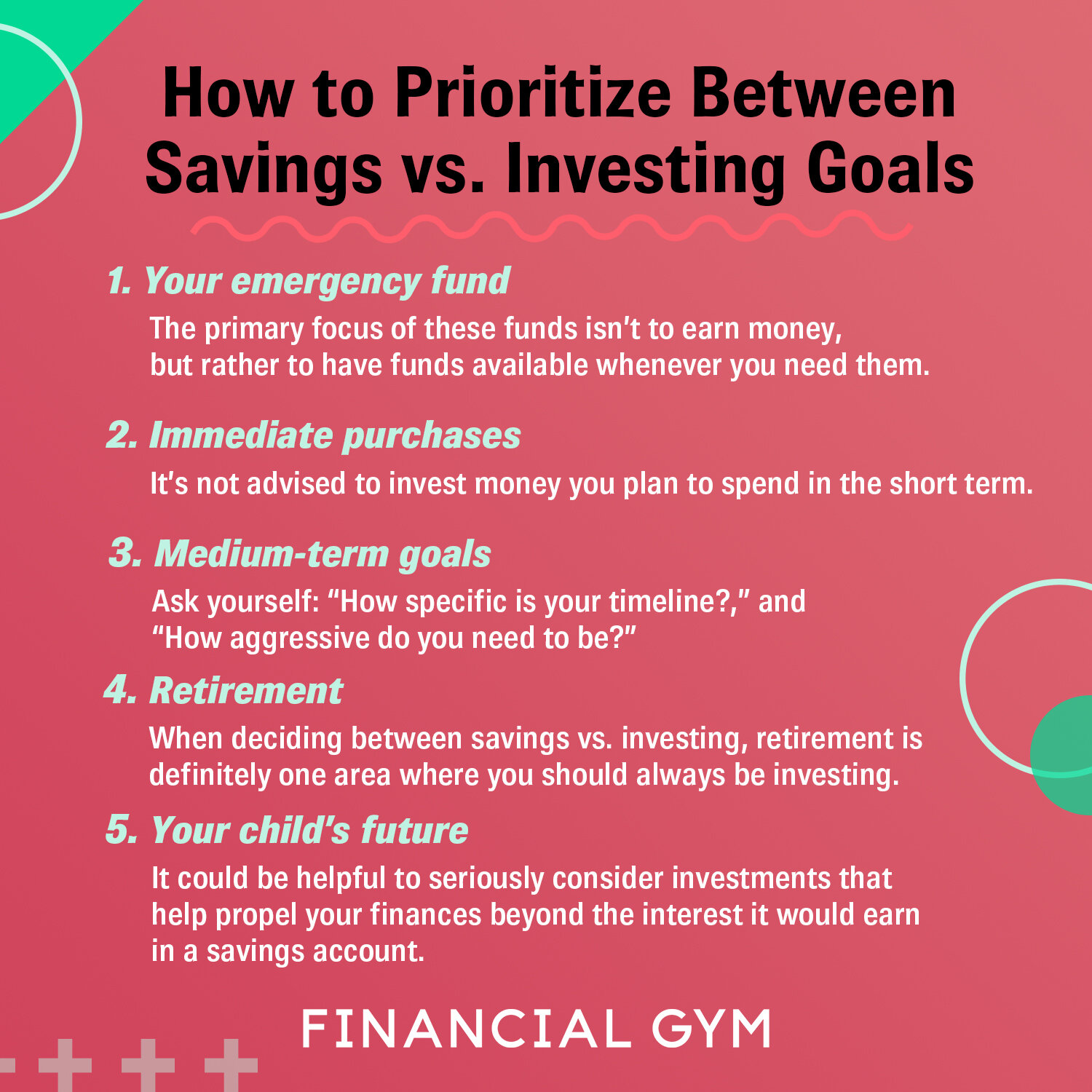

- Ratchet down that 10% if you don't yet have a healthy emergency fund and 10% to 15% of your income funneled into a retirement savings account. (nerdwallet.com)

External Links

How To

How to open a trading account

The first step is to open a brokerage account. There are many brokerage firms out there that offer different services. Some have fees, others do not. Etrade, TD Ameritrade and Schwab are the most popular brokerages. Scottrade, Interactive Brokers, and Fidelity are also very popular.

After opening your account, decide the type you want. Choose one of the following options:

-

Individual Retirement accounts (IRAs)

-

Roth Individual Retirement Accounts (RIRAs)

-

401(k)s

-

403(b)s

-

SIMPLE IRAs

-

SEP IRAs

-

SIMPLE 401(k)s

Each option has its own benefits. IRA accounts have tax benefits but require more paperwork. Roth IRAs permit investors to deduct contributions out of their taxable income. However these funds cannot be used for withdrawals. SIMPLE IRAs can be funded with employer matching funds. SEP IRAs work in the same way as SIMPLE IRAs. SIMPLE IRAs are simple to set-up and very easy to use. These IRAs allow employees to make pre-tax contributions and employers can match them.

Next, decide how much money to invest. This is the initial deposit. Many brokers will offer a variety of deposits depending on what you want to return. For example, you may be offered $5,000-$10,000 depending on your desired rate of return. The lower end represents a conservative approach while the higher end represents a risky strategy.

After deciding on the type of account you want, you need to decide how much money you want to be invested. Each broker will require you to invest minimum amounts. The minimum amounts you must invest vary among brokers. Make sure to check with each broker.

Once you have decided on the type of account you would like and how much money you wish to invest, it is time to choose a broker. Before selecting a broker to represent you, it is important that you consider the following factors:

-

Fees: Make sure your fees are clear and fair. Brokers often try to conceal fees by offering rebates and free trades. However, some brokers raise their fees after you place your first order. Be wary of any broker who tries to trick you into paying extra fees.

-

Customer service: Look out for customer service representatives with knowledge about the product and who can answer questions quickly.

-

Security – Choose a broker offering security features like multisignature technology and 2-factor authentication.

-

Mobile apps - Find out if your broker offers mobile apps to allow you to view your portfolio anywhere, anytime from your smartphone.

-

Social media presence. Find out whether the broker has a strong social media presence. If they don’t, it may be time to move.

-

Technology - Does this broker use the most cutting-edge technology available? Is the trading platform easy to use? Are there any problems with the trading platform?

Once you've selected a broker, you must sign up for an account. While some brokers offer free trial, others will charge a small fee. After signing up, you'll need to confirm your email address, phone number, and password. Next, you will be asked for personal information like your name, birth date, and social security number. The last step is to provide proof of identification in order to confirm your identity.

Once you're verified, you'll begin receiving emails from your new brokerage firm. These emails contain important information and you should read them carefully. These emails will inform you about the assets that you can sell and which types of transactions you have available. You also learn the fees involved. Keep track of any promotions your broker offers. These could include referral bonuses, contests, or even free trades!

Next is opening an online account. An online account can usually be opened through a third party website such as TradeStation, Interactive Brokers, or any other similar site. These websites are excellent resources for beginners. When you open an account, you will usually need to provide your full address, telephone number, email address, as well as other information. After you submit this information, you will receive an activation code. This code will allow you to log in to your account and complete the process.

You can now start investing once you have opened an account!